Be You. And We’ll Be There For You, Too.

Brighton Securities is owned, operated, and driven exclusively by our advisors. It’s our goal to develop our advisors to help them become equity partners in our firm. We support our advisors with dedicated marketing plans, experienced mentorship, and the technology to get the job done efficiently and effectively.

It's Time To Partner With Brighton Securities When:

- You are seeking a simple and transparent compensation structure.

- You want freedom to design and execute your own business plan; building a brand focused on YOU.

- Your AUM hasn’t grown at the pace you’d like.

- You want to work with a firm who understands and is responsive to your needs and goals.

Why Partner with us?

Our compensation structure is straight forward, and our commissions are paid on a progressive scale up to 65%. No deferred payments, cross-sell requirements, or account minimums. *Advisory accounts are fee-based.

Always Advocating For Your Success.

We’ll be there every step of the way serving as a confident, trusted partner. We'll help you develop and execute a personalized business plan, tailored to support you at every career stage – celebrating your success along the way.

IF YOU'RE READY TO GROW YOUR BUSINESS, BECOME A BRIGHTON SECURITIES FINANCIAL ADVISOR TODAY.

a

a

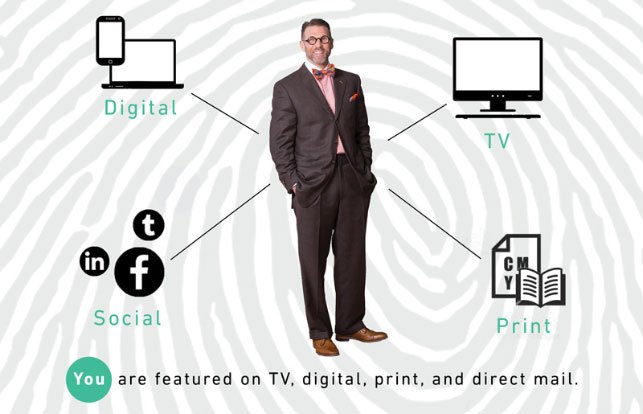

No two Financial Advisors are alike. We'll work with you to develop custom marketing plans centered around you and your goals to best position your business for growth.

You will be given a personal marketing budget, access to digital marketing tools, and a dedicated marketing team focused on ensuring your personal business success.

At Brighton Securities, we take a wholistic, client-centric approach to delivering wealth management and financial services. Our suite of products and services allows you to provide the value and solutions your clients need including:

- Financial Planning

- Saving Strategies

- Insurance Solutions

- Estate Planning

- Corporate Services

- Modeled Investment Portfolios

- Tax Planning & Preparation via Brighton Securities Tax & Accounting Services

Transitioning your business doesn’t have to be complicated.

We understand that maintaining the client relationships that you have dedicated your career building is paramount. That’s why we support you with a dedicated team that ensures a seamless transition and experience for you and your clients.

Your support team includes subject matter experts in compliance, strategy & development, marketing, and client support to cover all the bases. With their help, Advisors who join Brighton Securities have successfully transitioned over 90% of their business.

Brighton Securities is committed to the success of our Financial Advisors – we'll be there for you, so you can be there for your clients.